We back the next generation of venture funds poised for exceptional alpha

Our investment strategy is based on four core pillars

Emerging Managers

Early funds are where managers optimize for outsized returns to build their reputation and carried interest—not management fees.

U.S. Focus

With supportive government policies and world-class infrastructure, the U.S. provides a solid foundation and fertile grounds for businesses to scale and thrive.

Solo GPs

We back solo GPs who combine operating experience with strong investment expertise, enabling them to identify, support, and scale high-potential founders.

Thesis Driven Tech Funds

We prioritize specialists and thesis-driven funds with deep expertise and strong industry ties, giving them an edge in sourcing and selecting high-potential opportunities.

We are constantly looking for emerging managers with an operational track record, clear competitive edge, and a concentrated portfolio construction. We invest in new, early-stage venture capital funds that are difficult to find, evaluate and access.

In today’s climate, we seek to take advantage of the reset within venture and to participate in what we believe will be some of the most successful vintages for venture investing. We give access to our partners to a pool of top-decile funds that have an embedded layer of diversification to further mitigate risk.

Raida Daouk

Managing Partner

Raida started her career in banking before moving to the investment team of BY Venture Partner, a venture fund with offices in Beirut and Abu Dhabi. She quickly climbed the ranks within the company and ultimately became a Venture Partner. Recognizing a void in the market for personalized venture consulting services, Raida established Amkan Advisory, a boutique consultancy firm specializing in assisting family offices and high-net-worth individuals in identifying venture funds that align with their specific strategies. Furthermore, Raida successfully established and managed the venture arm of Bridge Capital Holding, a single-family office, overseeing the entire venture capital allocation. In response to the increasing demand from clients for emerging managers in the United States, Raida took the initiative to create Amkan Ventures, a fund of funds bridging LPs to markets beyond their reach.

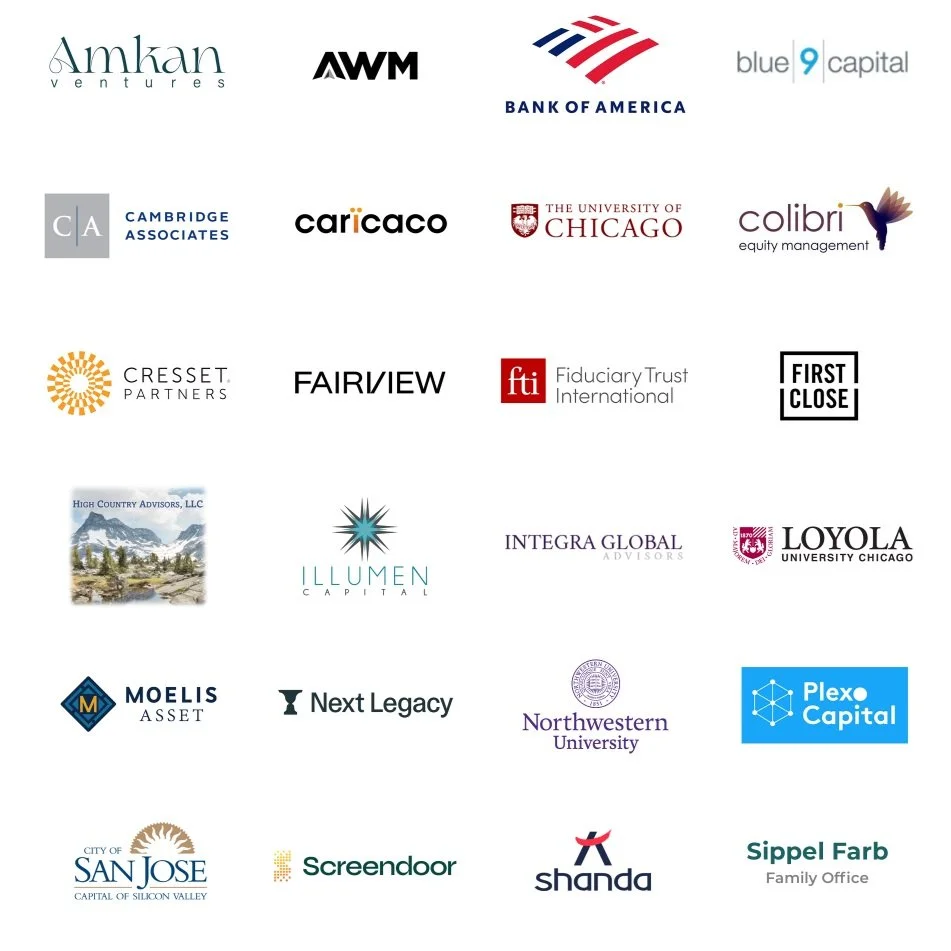

Portfolio Funds

A Personalised Approach

Amkan Advisory

We offer personalized consulting services to family offices, HNW individuals, and others, assisting them in developing and implementing effective strategies for their ventures.

Learn more at amkanadvisory.com

Let’s Chat!

For further inquiries, please reach out to hello@amkanventures.com